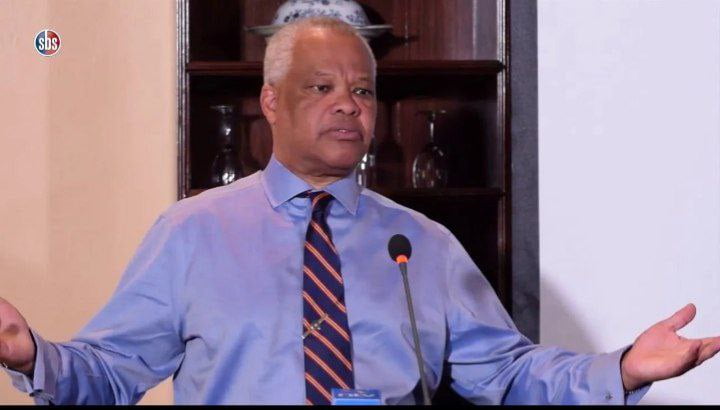

This is a distressing life experience narration detailing how 500K insurer left Robert Kariuki stranded on his sickbed when he contacted COVID-19.

Most of the Insurance companies are not covering Covid-19 related illnesses. NHIF too is not covering Covid-19 related tests.

While speaking to the Star, Robert Kariuki says he was turned away from Nairobi Hospital and Mater Hospital because his temperature was above 39 degrees.

Kariuki, had not undergone the Covid-19 test but he had all the symptoms including shortness of breath, dry cough, a rather high temperature, yet hospitals could not admit him.

Here is Robert Kariuki’s story

I was rained on last week when I was on my way home. The following day, I developed flu-like symptoms that I ignored after taking a painkiller off the counter. When the symptoms persisted, I went to a hospital near Kiambu and the doctor recommended chest x-ray and some tests for pneumonia, which was positive.

No one ever suggested a Covid-19 test. The cough worsened, and became more frequent, especially if I moved suddenly or took a heavy breath. My body temperature also started rising. I took lemon and water, and this helped a lot.

On July 1, I sought help at Nairobi Hospital where Dr Kimani Gicheru recommended a blood test to confirm whether it was bacterial or viral pneumonia. Unfortunately, the hospital could not admit me because, at the time, it was full.

The next day, I tried to seek treatment at Mater Hospital. Here I was turned away after my temperature read 39 degrees.

The nurse who took the temperature readings called the admitting doctor to see if there was space for me. He said they were full and advised I should look for another facility.

I asked for first aid instead, and they said they don’t have the capacity to treat Covid-19 patients. This was the first time I was being identified as a Covid-19 patient. I begged for about 30 minutes. They took my number and name. I think I was blacklisted. At this point, I had lost appetite because the only thing I could taste was warm water.

I was in pain and had to look for an alternative. I proceeded to Nairobi West Hospital. My temperature at the gate read 39.5 degrees. I consulted with a medic inside the facility who informed me that their isolation unit was full.

I stepped out of the car and leaned on it and begged with them to admit me, but they said their wards were full. I even begged to use a toilet but they refused. God, what do I do now?

It was clear I might have Covid-19. I had heard media reports that KU (Kenyatta University Teaching, Research and Referral) Hospital was full.

But I was still going to try. So I decided to go rest at home, pick up clothes and travel there the following day,” he continued.

At 7 pm I was running out of breath, sweating and feverish. I was rushed to Avenue Hospital because I had been treated there in the past. The medics were helpful and demanded that I take a Covid-19 test.

Taking the nasal test was a struggle because every time I opened my mouth wide, I coughed. The deep nasal swab was painful. It’s like they tore through a membrane.

I still at the waiting room because the isolation ward was full. Other hospitals like MP Shah, KU, Radiant, Nairobi West and Mater were still not admitting.

At 3 am on July 3, one patient in isolation was moved to the recovery unit, and so a bed was available. My lungs were 40 per cent operational, which means if I had stayed home that night, I might have died.

My tests came positive and I was moved to the general Covid-19 ward. I stayed on oxygen for three days. I was drinking a lot of fluids but eating was a struggle. Sleeping was difficult because the oxygen is constantly being pumped into your nostrils, and the ventilator is noisy.

I was discharged on July 8 but had a Sh190,000 bill hanging over my head. I contacted my Insurer at 9 am but only responded at 7 pm informing the hospital that they could only cover the costs accrued before I tested positive for COVID-19.

The insurance company was willing to settle a Sh35,500 only. So I slept at the hospital one more night and incurred extra costs. I made a lot of calls and managed to secure a loan to cover the hospital bill, an expensive loan.

It still angers me that insurance companies are abandoning their Covid-19 patients yet I have a statement from Commissioner of Insurance Godfrey Kiptum, dated March 13, assuring Kenyans insurers would pay for coronavirus treatment.

Kenya has recorded an exponential spike of COVID-19 cases weeks after restrictions were relaxed and people allowed to move around freely. As of Tuesday, the toll stood at 14,168 with 6,258 recoveries and 250 deaths.