In a country where wealth inequality remains frighteningly wide, Kenya is well-acquainted with the notion of a significant elite group of super-rich persons known to hide their wealth in trusts and various consolidation of firms in order to evade or downplay taxes.

In the past, a good number of affluent and politically connected Kenyans appeared in the Panama Papers, a leakage that exposed the rogue offshore finance industry in April 2016.

To catch tax cheats and measure evasion, the Kenya Revenue Authority (KRA) has traditionally been relying on random audits carried out every financial year.

But as reality shows on the ground, such reviews are highly ineffective.

Most of them deliver little evidence of evasion among the extremely wealthy, in part because the rich use sophisticated accounting techniques that are difficult to trace, such as offshore tax shelters.

But recently, the KRA enforcement unit has adopted a different model where various databases are used to pursue suspected tax cheats.

These include bank statements, import records, motor vehicle registration details, Kenya Power records, water bills and data from the Kenya Civil Aviation Authority (KCCA), which reveal individuals who own assets such as helicopters.

Car registration details are also being used to smoke out such individuals who are often spotted cruising in high-end fuel guzzlers but have little or nothing to show in terms of taxes remitted.

In one such crackdown which KRA initiated early this year, the agency identified a group of Kenya’s 20 High Net-Worth Individuals (HNWI) from whom they target more than Sh5 billion in extra revenue.

A sizable chunk of these persons is reported to be among persons hiding a massive swathe of their earnings from the State.

So, who are Kenya’s serial tax evaders?

Within this plan that is expected to last up to June 2024, KRA employs a variety of tactics including deactivation of Personal Identification Numbers (PINs), freezing of assets, and issuance of travel bans for cases featuring severe notoriety.

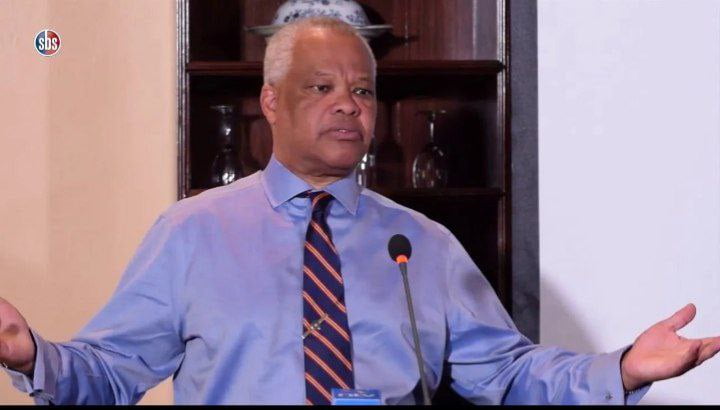

1. Mohamed Jaffer

In one such incident recorded last year, KRA raided Mombasa billionaire businessman Mohamed Jaffer over a suspicious tax evasion scheme among his chain of companies across oil, grains and liquid petroleum gas industries.

While pilot testing their new plan in October 2020, the taxman obtained a court order and went on to grab documents from the companies for analysis.

The shocking findings revealed that the companies, One Petroleum Limited, Africa Gas and Oil Company Limited, One Gas Ltd and Grain Bulk Handling Limited had evaded taxes amounting to over Sh68 million.

Further analysis of the documents revealed a massive under-declaration or omission of sales.

As a result, KRA withdrew tax compliance certificates for Jaffer’s companies on the basis that the companies were owned by the same families and investigations will involve all of them.

The companies had shared directors including; Mujtaba Mohamed Jaffer, Ali Abbas Jaffer and Mohamed Husein Jaffer.

The raid was a rare surprise since the family is known to have close ties to powerful politicians in and out of the government.

But as expected, Jaffer’s companies got off the hook on alleged “technical grounds”.

The court threw out KRA orders cancelling the tax compliance because the taxman apparently “withdrew the certificate via email without notice or offering the billionaire a chance to defend himself”.

This strongly puts into question the effectiveness of these new efforts by the taxman and explains why billionaires like Jaffer who sit on illegally accumulated wealth continue to roam free in Kenya.

Jaffer controversially built his business empire by leveraging on political patronage and was at one time the main benefactor of ODM Party Leader Raila Odinga when he served as Prime Minister.

Jaffer’s influence is not only limited to the executive arm of government.

He is said to be close to high ranking judges in the Judiciary including distinguished magistrates like Court of Appeal Judge Alnasir Visram.

With such deep connections within the corridors of power, it is no wonder that the tycoon wins a majority of cases filed against him or any of his firms.

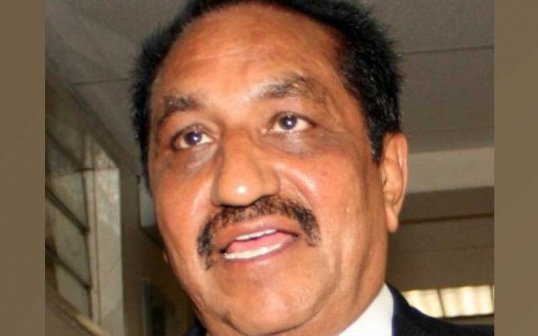

2. Mohan Galot

Aside from Jaffer, the taxman is also in pursuit of other tax-evading billionaires like the Director of London Distillers Kenya Limited, Mohan Galot who is said to owe the state agency over Sh2.1 billion.

Galot appeared before Milimani Chief Magistrate Martha Mutuku in July 2021 and was charged alongside London Distillers Kenya Limited with 18 counts of tax evasion related offences.

This was after a series of investigations which revealed that the Company had grossly underdeclared production volumes of excisable products.

Galot’s company failed to declare VAT sales worth Sh3.5 billion with a VAT tax implication of Sh563 million for the years 2015, 2016, 2017 and 2019, which was declared an offence contrary to the VAT Act No. 35 of 2013.

He was also accused of failing to declare production volumes of 168,157 litres of ready to drink beverage and 8,048,268 litres of spirit in 2016, 2017 and 2019 .

This, according to the court papers, led to a revenue loss of Sh1.5b in excise duty.

3. Vimal Shah

After Galot, another name on KRA’s list of tax-evading High Net-Worth Individuals (HNWI) is Bidco boss Vimal Shah.

Bidco Oil Refinery Ltd is one of the leading manufacturers and marketers of cooking oil, fats and soaps in Kenya, which puts it under constant scrutiny by KRA.

Sometime in September 2009, KRA decided to assess Bidco’s imports duty bill and established that it was in arrears of Sh702 million.

On September 16, 2009, KRA wrote to the company demanding the money.

In 2013, the company was ordered to pay Kenya Revenue Authority (KRA) an amount in excess of Sh1.3 billion n after a petition challenging the amount was dismissed by the High Court.

The origin of the dispute between Bidco and KRA can be traced back to a contract for the import of edible oils and related products from Josovina Commodities Limited in Singapore by Bidco.

KRA carried out an audit into Bidco’s imports for the years January 2004 to July 2008, and alleged undervaluation of value-added tax and duty payable on the contract due to tariff misclassification and value undervaluation.

Most recently, Human Rights Activist, Okiya Omtatah sued Bidco in 2016 for colluding with KRA and the Attorney General to deny the exchequer Sh. 5.7 Billion in what he described as defeating public interest in recovering the money.

In an application filed before Justice Isaac Lenaola, Omtatah said the taxman failed to collect money that would uplift living standards.

Omtatah also accused Bidco Africa Chief Executive Officer Vimal Shah of ensuring that the company does not pay taxes over the years.

In the suit, Trans Nzoia Senator Henry ole Ndiema is alleged to have broken the law when he exempted Bidco Africa from paying taxes when he served as a civil servant in the Ministry of Finance in the 1990s.

Omtatah backed his claims with a whistle-blower’s report that claimed Bidco has survived by not paying its rightful share of taxes since then.

He also cited the High Court decision of 2013 which allowed KRA to collect tax arrears and other fees amounting to Sh1.3 billion from Bidco Africa.