Banks have reduced the cost of credit to the lowest level in 29 years due to a consistent drop in the Central Bank of Kenya (CBK) benchmark lending rate. The drop is also attributed to reduced rate at which lenders extend credit to high-risk borrowers during this Covid-19 pandemic.

The new trend has reduced fears of a rise in the cost of credit after the treasury removed interest rate cap last November.

Latest data from CBK shows that lending rates have been down for consecutive months to an average of 11.9% in April. Which is the lowest since CBK began making the lending rate public in July 1991 when Eric Kotut was the governor.

In November 2019, Kenya scrapped the cap on commercial lending rates which was stalling lending to small businesses and individuals. The removal of the legal cap resulted to fears of a possible return to the era of high cost of loans which hit 25% at some point.

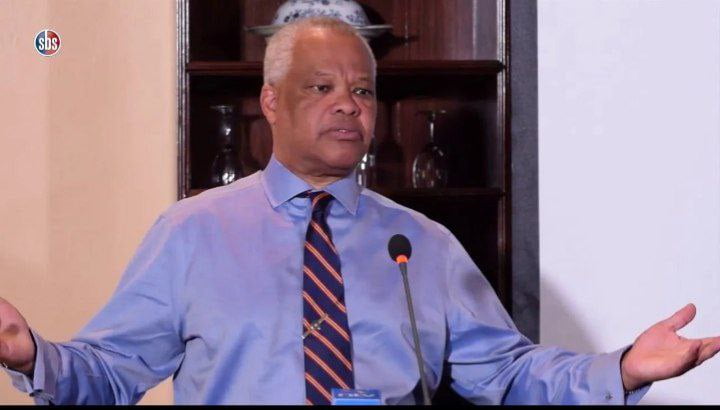

Kenya Bankers Association (KBA) C.E.O Habil Olaka said the lower cost of loans was in line with a fall in the benchmark lending rate as well as risk averseness by banks since the covid-19 outbreak in March.

“Lenders have become risk conscious and so they are not going for very high risk borrowers, which will require banks to charge rates commensurate with the risk.” said Olaka.

Mr Olaka also said that lenders have been reviewing the appetite of borrowers in line with risk-based pricing models, but Covid-19 has negatively affected the speed at which this can be done.

“They are starting with acceptable risk first then onboarding high risk ones gradually. But given the Covid-19 challenge, very high risk borrowers will not be attractive to banks until the economic situation improves,” he added.

The increased demand for new loans has also been hit and therefore the old loans that were pegged on the CBR (Central Bank Rate) cannot be increased.

In May CBK retained the benchmark lending rate at 7%, because the economy is operating below potential. The move to maintain the lending rate therefore was meant to cushion the economy from the harsh effects of Covid-19.

CBK also lowered the cash reserve ratio for commercial banks from 5.25 % to 4.25% which released an extra Sh35.2 billion for banks to lend to customers.